Big Pharma Executive Assassination Marks The Death of Health Privacy

The deeper we go, the weirder it gets

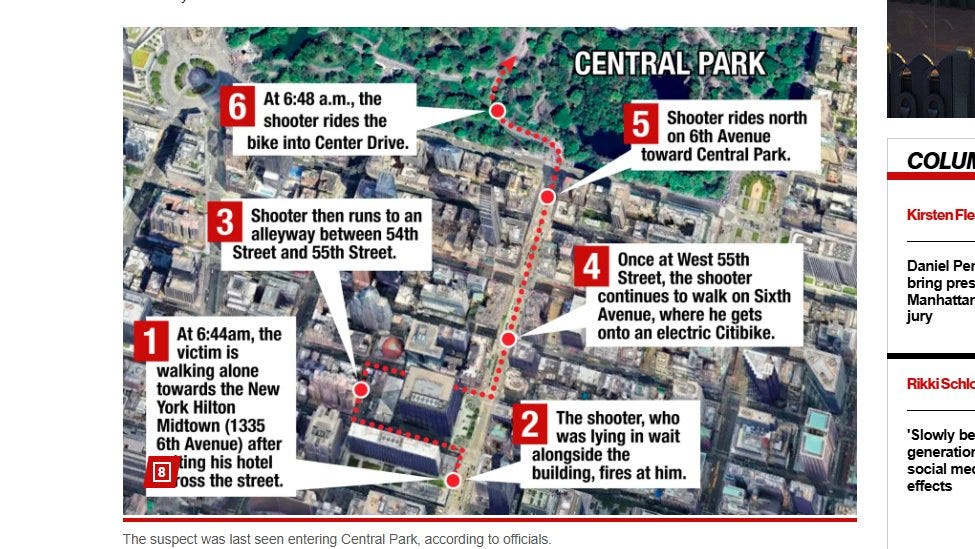

On December 4, Brian Thompson CEO of United Health’s UNH.N insurance unit was murdered in a targeted attack outside of a Manhattan hotel around 6:45 am.

The gunman waited for Thompson to exit before executing the attack. The suspect, wearing a mask and carrying a gray backpack, fled on foot before mounting an electric bike and riding into Central Park, police said.

UnitedHealth is the largest U.S. health insurer, providing benefits to tens of millions of Americans, who pay more for healthcare than people in any other country. Thompson had been the CEO of UnitedHealthcare, a unit of UnitedHealth Group, since April 2021. Key statistics here.

Video of the attack below:

Shortly after the attack:

Keep in mind that some sources are referring to a 'she’. For the purposes of this analysis, we actually don’t know, and I don’t care.

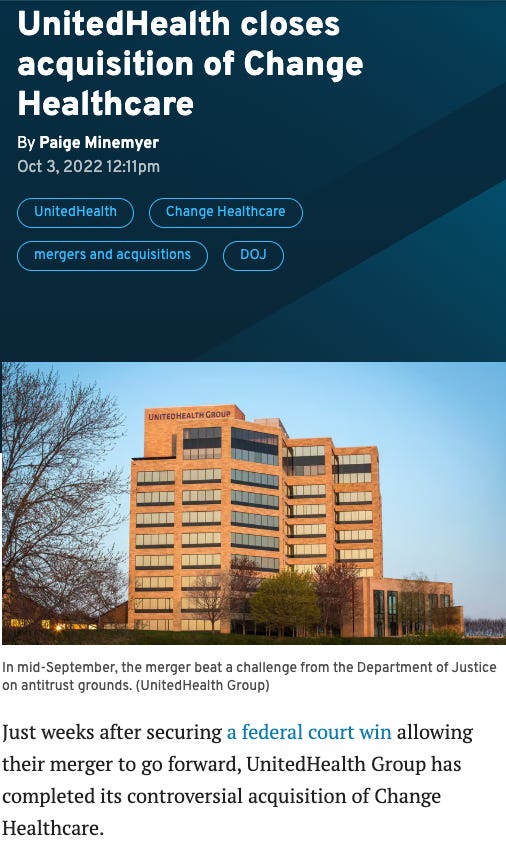

The U.S Department of Justice sparked an anti trust probe around a major acquisition

The acquisition was first announced in January 2021. The companies were allowed to close the deal after divesting Change's ClaimsXten business to satisfy the court.

DOJ investigators have been interviewing healthcare industry officials that compete with UnitedHealth, asking about relationships between UnitedHealthcare insurance and Optum health services businesses.

11 Individual defendants named in the lawsuit are UnitedHealth Group CEO Andrew Witty, chairman Stephen Hemsley and UnitedHealthcare CEO Brian Thompson.

The judge said the DOJ failed to provide enough evidence to prove UnitedHealth would misuse competitor data to gain an unfair advantage. UnitedHealth executives testified they already have access to this data through Optum and misusing it would significantly harm the company financially.

In mid-September, a federal judge ruled in favor of allowing the $13 billion merger to proceed, after the DOJ had argued it would give UnitedHealth access to sensitive data on competitor health plans that it could exploit.

A monopoly was created

UnitedHealth maintains Optum has an arm's length relationship with UnitedHealthcare, or otherwise a ‘group monopoly’.

Acquisition Would Allow Health Care Giant to Use Competitively Sensitive Claims Data of Hundreds of Millions of Americans to Reduce Competition and Innovation to the Detriment of Health Insurance Consumers.

The DOJ had major concerns.

“The proposed transaction threatens an inflection point in the health care industry by giving United control of a critical data highway through which about half of all Americans’ health insurance claims pass each year,” said Principal Deputy Assistant Attorney General Doha Mekki of the Justice Department’s Antitrust Division.

“Unless the deal is blocked, United stands to see and potentially use its health insurance rivals’ competitively sensitive information for its own business purposes and control these competitors’ access to innovations in vital health care technology.

Other recent corporate activity:

Here are six of UnitedHealth's biggest mergers and acquisitions of 2022:

UnitedHealth Group's Optum acquired Refresh Mental Health from private equity firm Kelso & Co.

Optum agreed March 29 to buy Lafayette, La.-based LHC Group in a $5.4 billion deal.

Optum finalized a deal to acquire Houston-based Kelsey-Seybold Clinic, Axios reported April 4. Kelsey-Seybold is a group practice offering treatment in 55 medical specialties across 24 locations in the Houston area and employs more than 500 physicians and allied health professionals.

The Massachusetts attorney general's office gave Optum clearance to buy Atrius Health, a 30-location independent physician organization, on April 21.

UnitedHealth disclosed in a regulatory filing it acquired KS Plan Administrators, a Medicare health insurer in Houston, the Star Tribune reported Aug. 16.

UnitedHealth completed its $7.8 billion acquisition of Change Healthcare on Oct. The deal merges Optum Insight with the healthcare data and analytics giant. Was previously called anticompetitive because Change Healthcare has access to data from insurer customers. (source)

The Justice Department had argued that the deal would give UnitedHealth a virtual monopoly on an important tool that health insurers use to determine when a claim should be paid. And it said the company shouldn’t be allowed to own Change Healthcare’s data clearinghouse, which rival insurers use to compete with UnitedHealth.

Judge Nichols landed on the side of Big Pharma between Pharma and the insurance industry. In legal speak, imagine trying to pick the lesser evil between them? I can’t.

The court loss is an early setback for the Biden administration's efforts to step up antitrust enforcement. DOJ antitrust chief Jonathan Kanter said they disagreed with the ruling and were evaluating next steps.

Judge Nichols appeared skeptical of the government's arguments in earlier hearings. He is requiring UnitedHealth to divest claims-processing assets to address competitive concerns. U.S. District Judge Carl Nichols denied the DOJ's request to block the deal in a sealed opinion, saying he would release a redacted public version in the coming days.

It's a major win for UnitedHealth, allowing it to expand its Optum health-services division. UnitedHealth is the largest U.S. health insurer and already owns a large healthcare provider business and trove of health data.

Blackrock and conflicts of interest

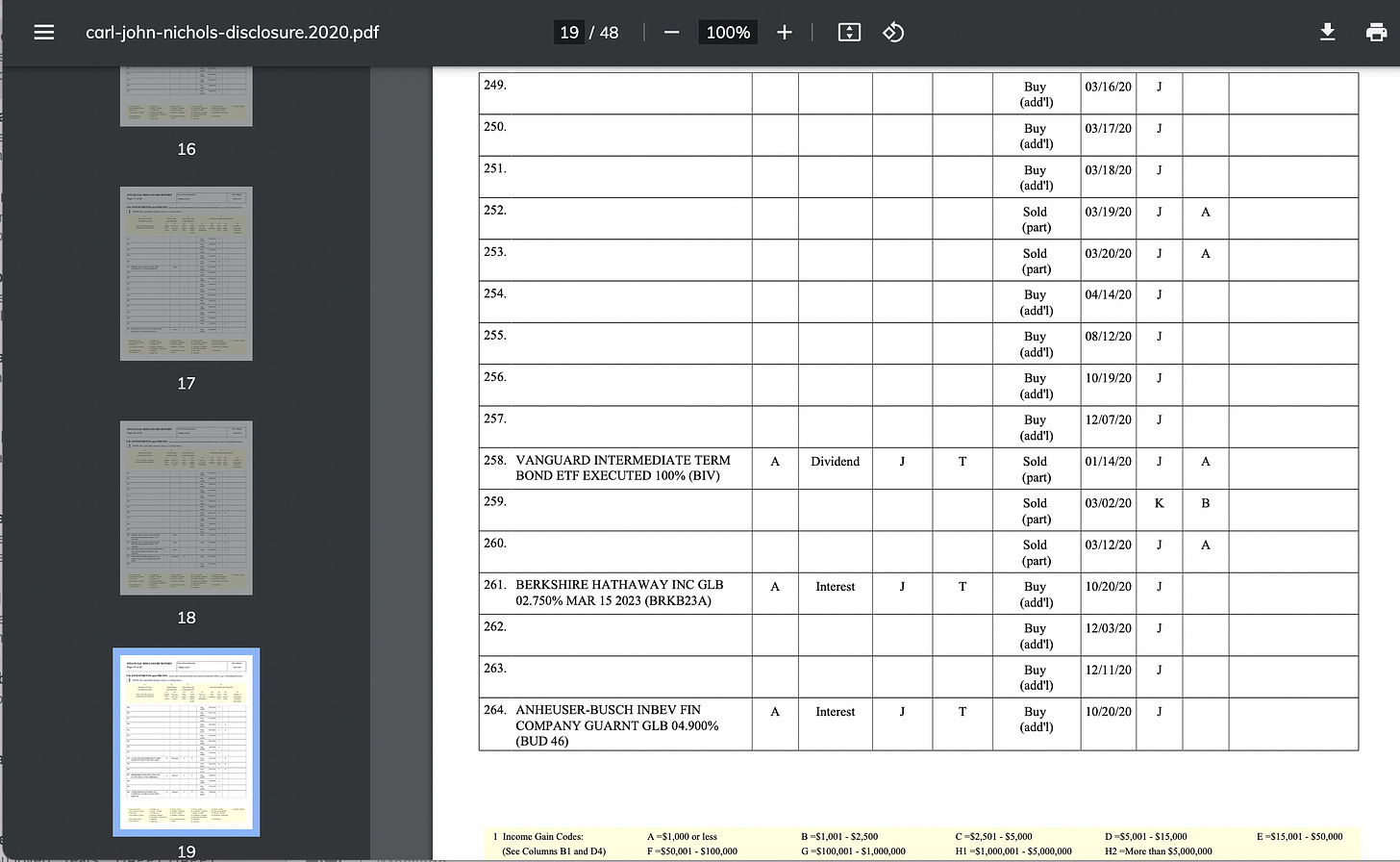

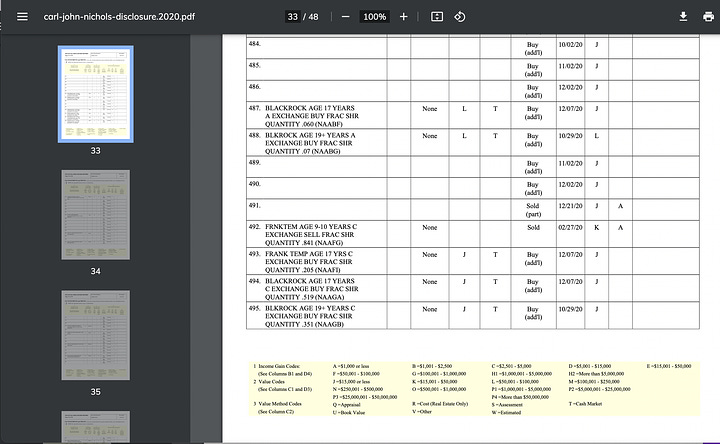

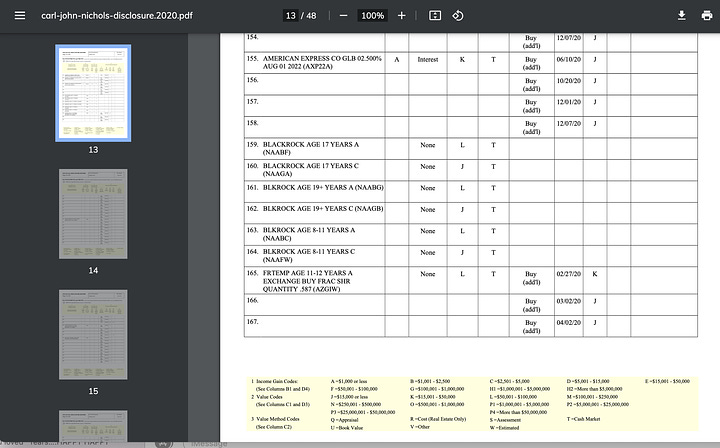

Financial disclosures of Judge Nichols show a lot of Blackrock.

BlackRock has ownership of 74.42 M shares of UnitedHealth Group Inc (UNH). This is 8.0% of the company. Profiles available here, here, and here. The increase of ownership of the company had increased from before the merger.

The judge also has disclosures of Vanguard and Berkshire Hathaway.

They must love that judge!

Its worth noting that UnitedHealth Group is a major-major lobbier.

Privacy is dead. What’s next?

As I mentioned earlier, this merger was the end of health privacy at the hands of Big Pharma. Let’s consider what this means. Will it perhaps overlap with some those wacky QAnon conspiracies? Maybe not in the same technologies, but the industry is heading in a scary direction.

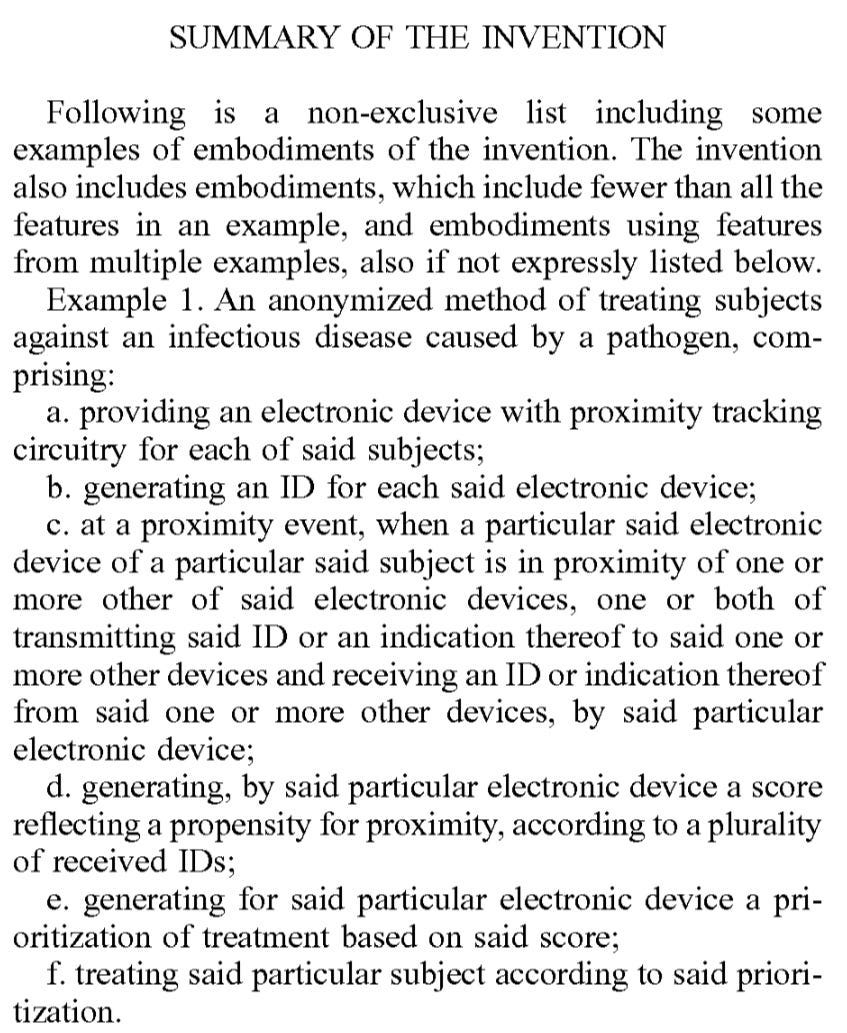

The patent (US11107588B2) was filed by Gal Ehrlich and Maier Fenster of Ehrlich & Fenster Ltd. in Israel. They are listed as the inventors.

The patent document does not disclose who, if anyone, is currently developing tools based on this patented method. The assignee or any licensees they grant could potentially develop such tools.

Governments and health organizations interested in the vaccine prioritization approach could potentially engage the patent holders to utilize the method. Tech companies or analytics firms may also be interested in licensing the patent to build tools based on the methodology.

There are some high-level similarities between the method described in this patent and the data analytics that UnitedHealth Group could potentially perform after acquiring Change Healthcare's claims data and technology:

Both involve analyzing large amounts of health-related data to gain insights and inform decision-making. The patent focuses on interaction data to guide vaccination efforts, while UnitedHealth would be looking at claims data for various purposes.

Both use sophisticated data processing and analytics tools, potentially including machine learning and AI, to generate actionable intelligence from raw data.

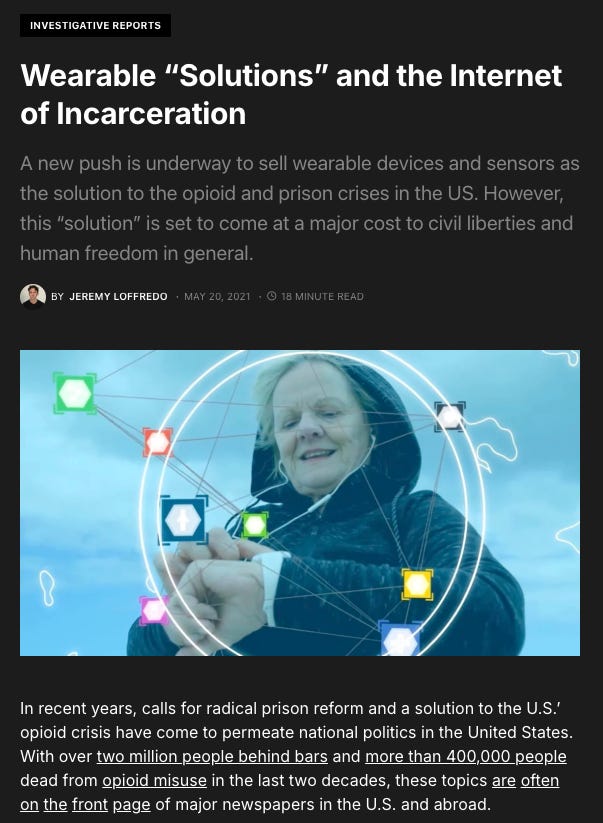

Private companies partnered with the WEF are promoting wearables to monitor things like addiction risk and compliance with parole restrictions as alternatives to traditional treatment and incarceration. The federal government is providing funding for development of these technologies.

An internet of incarceration

The COVID-19 pandemic has accelerated the push for health surveillance wearables and removed regulatory barriers. This aligns with the WEF's "Great Reset" agenda.

The technology pathway historically develops from the monitoring and tracking of prisoners, ie in prisons. The new paradigm of health, as a doorway to tracking, is to use technology in the same was as has been done for prisoners. Let this sink in.

Critics argue that rather than reforming the system, this "digital incarceration" simply extends the reach of surveillance and control beyond prison walls, threatening privacy and liberty on a mass scale. Less privileged groups are likely to be impacted first.

the Technological Incarceration Project (TIP) was described in an article by Antony Funnell a few years ago, in which Dan Hunter is highlighted. A dean of a law school, studying AI in forms of social control, describes the technological applications as an internet of incarceration.

For example. This system could deliver an incapacitating shock via an electronic anklet if the AI detects an impending crime or violation. It would be far less expensive than human surveillance.

To conclude

It was pretty weird.

From the total lack of hesitation in the assassination, to the strange gun cycling problem. The cycling does not happen when one has a proper silencer and knows how to use, and prep a firearm. And then the killer wanders around for a few blocks until landing the park?

Grabbing a bike that is traceable, including by transaction data to rent the bike. The bike would have GPS.

Went to Starbucks also.

Starbucks!?

Nobody is particularly “mourning”.

Here’s some satire.

The official narrative might as well be satire.